- Searching on www.60secondpremier.com and application process

- Simple First Premier Card login procedure

- My Premier Credit Card Review

- Bank promotion links

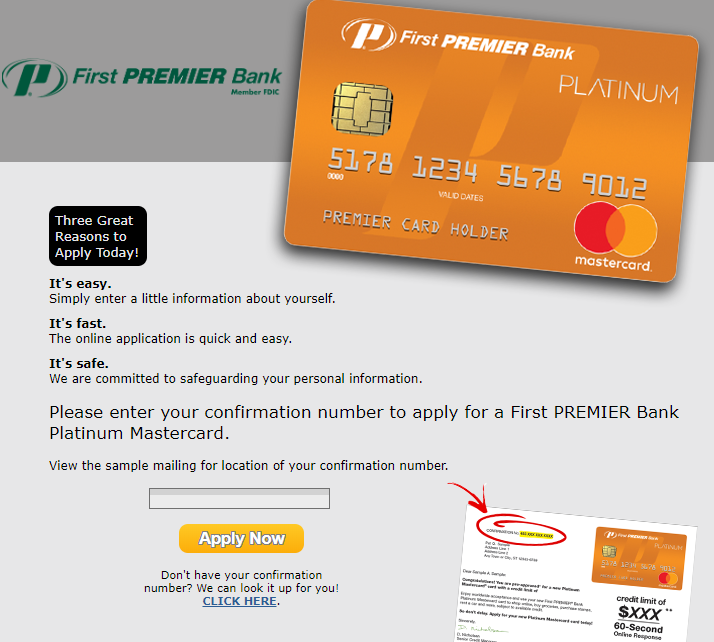

Have you found the offer letter from First Premier Bank with confirmation number in your mail? Congratulations! This means that you have a chance to become an owner of a new beneficial credit card – 60SecondPremier. It is platinum named pre-approved card which comes under the Master Card types.

And those who have a code can use it at www.60secondpremier.com website to check the status and ask for the approval. Of course, except the number you also have to provide some personal information. In this way, you receive an opportunity to use the card. And consequently, you will be able to manage personal MyPremierCreditCard account via the same portal.

Read the following information to find out about:

- Searching on www.60SecondPremier.com and application process

- Simple FirstPremierCard login procedure

- MyPremierCreditCard Review

- Bank promotion links

Searching on www.60secondpremier.com and application process

This website allows customers to check their eligibility for the card. The good news is that even those who have low or bad credit scores can be the owners of the credit card. Moreover, they have a chance to build their score up with it. So, do not overlook your chance.

You need to use your laptop, tablet or smartphone and enter the link into you browser search line and visit the webpage. There you will not find a lot of waste information like it usually happens with other similar online resources - only one field, where you should provide the confirmation number from the mail. Click the “Apply now” button.

Take into account that only legal residents of the USA who are at least 18 years old can be pre-approved and receive a confirmation number.

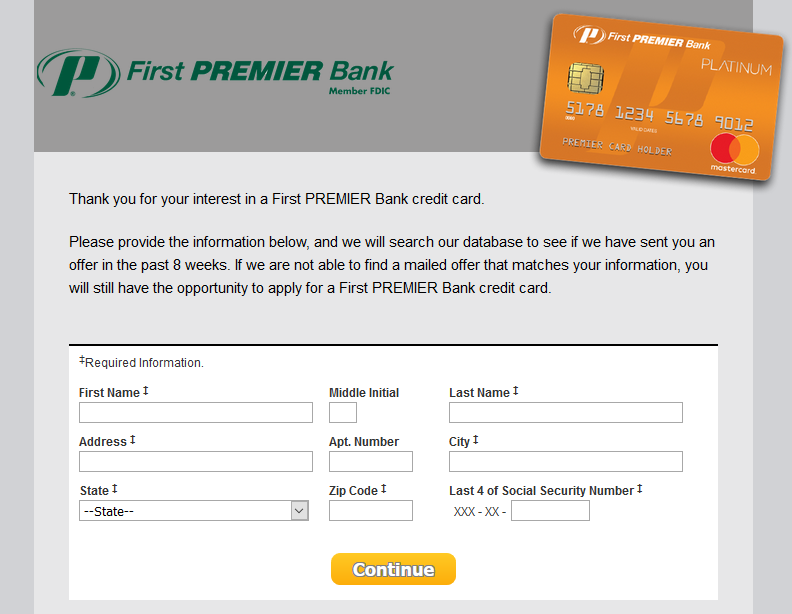

If you don’t have this number, there is the special link below called CLICK HERE. On the page that opens, you will need to provide first name, last name, address, social security number.

Simple First Premier Card login procedure

Firstly, it is necessary to sign up for an account which you have created. Then you are to use the following steps for this reason:

- Visit the main online page of the bank

- Provide username and password

- Obtain access to your account.

Those who have a personal account are able to:

- Check your balance

- Check statements online

- Find information about credit

- Check transactions

- Make online payments

- Other useful online options

My Premier Credit Card Review

Using the represented credit card, you should count on:

- Its credit limit is $700

- There is no sign-up bonus

- There are no cash back and other bonuses

- You have to pay a high annual fee in case of bad credit score

At the same time, this is a good choice for those who would like to improve or build up a good credit score. It is easy to obtain and offers most of usual credit card options which are important for customers. For example, you can make safe online and offline payments or take advantage of free-cost loan which is kept on about 25 days.

Additionally, each customer can use online app that simplifies account managing. For example, it is possible to view statement and banking mail, create a payment schedule, increase credit limit online, etc.

Bank promotion links

Get more detailed information at:

Bank website: www.firstpremier.com

Promotional webpage: www.60secondpremier.com

FAQ

How do I check my First Premier credit card balance?

Simply log into Online or Mobile Banking (note: enrollment and/or download may be required for initial use). You can also call Bank-by-Phone at 800-315-6350 and follow the prompts to enter your account information to check your balance. You can also call 800-501-6535 to speak to Customer Care.

How do I pay my first Premier credit card?

Call First Premier Bank at 1-800-987-5521 to make a payment by phone using your personal checking account (not a business account) or your debit card. You'll need to have your debit card number (or your bank's routing number and your checking account number) and your credit card number handy before dialing.

What is the phone number to First Premier Bank?

1 (800) 501-6535First Premier Bank

Does First Premier Bank have a app?

If so, have you downloaded First PREMIER Bank's credit card app? Available for both iOS and Android, this app provides First PREMIER Bank credit card customers with the same functionality as mypremiercreditcard.com, but with the benefit of being able to securely access information on the go.

How do I check the balance on my first Premier credit card?

Simply log into Online or Mobile Banking (note: enrollment and/or download may be required for initial use). You can also call Bank-by-Phone at 800-315-6350 and follow the prompts to enter your account information to check your balance. You can also call 800-501-6535 to speak to Customer Care.

How do I pay my first Premier credit card?

Call First Premier Bank at 1-800-987-5521 to make a payment by phone using your personal checking account (not a business account) or your debit card. You'll need to have your debit card number (or your bank's routing number and your checking account number) and your credit card number handy before dialing.

Why does my first Premier card ask for a pin?

This PIN confirms your identity, providing an added layer of security. When you insert your chip card into the terminal, you may be prompted to enter your PIN instead of your signature to complete the purchase. First PREMIER Bank cardholders: You need to have a PIN to use your chip-enabled card.

Does First Premier allow cash advance?

First thing you should know about getting a First Premier Bank credit card cash advance is that you will be able to get a cash advance at virtually any ATM, provided you have a PIN. You can get a PIN by calling the number on the back of your card. The cash advance fee's 5% or , whichever's greater.